Figure 3 | Optimal Investment and Consumption Decisions under the Constant Elasticity of Variance Model

Figure 2 | Optimal Investment and Consumption Decisions under the Constant Elasticity of Variance Model

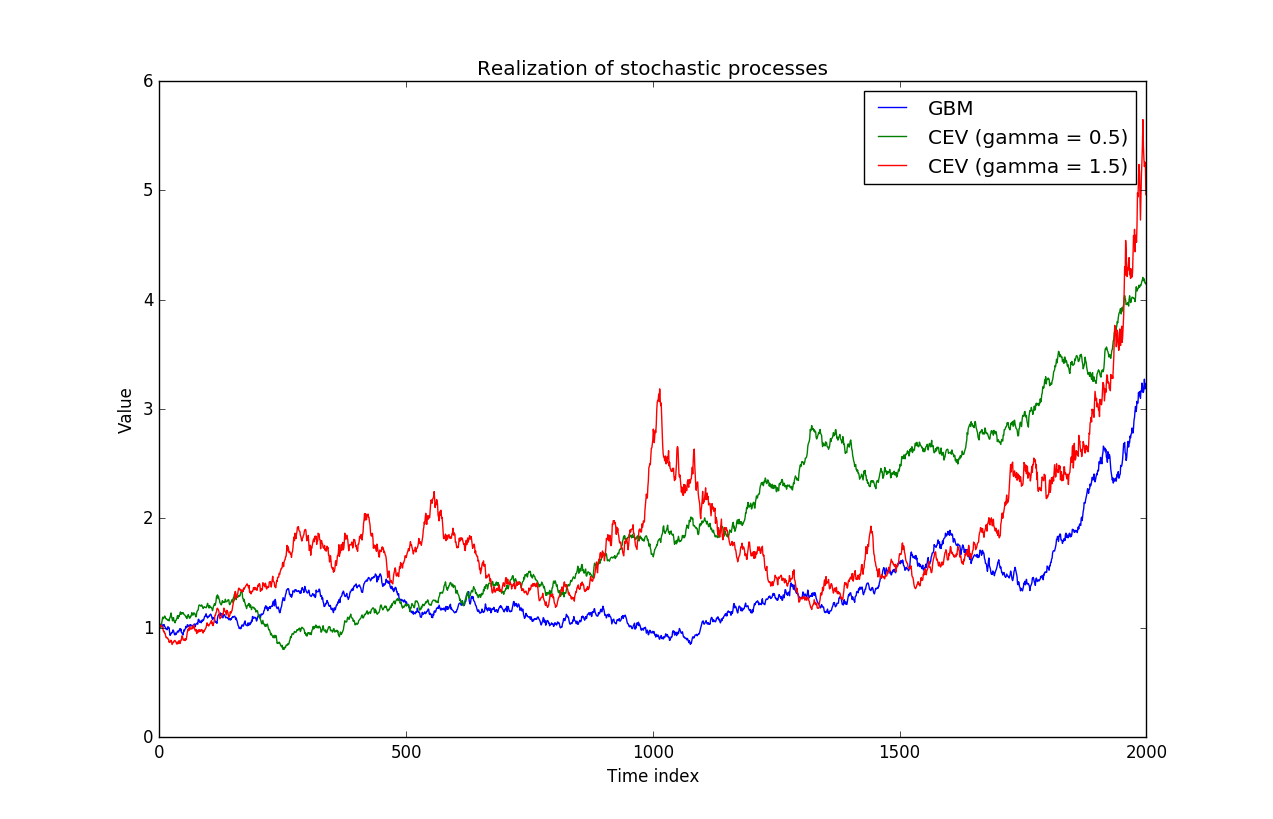

Constant Elasticity of Variance model. Parameter values: K = 100, σ =... | Download Scientific Diagram

Constant Elasticity of Variance (CEV) Option Pricing Model:Integration and Detailed Derivation - PDF Free Download

Optimal Investment Problem with Multiple Risky Assets under the Constant Elasticity of Variance (CEV) Model

Constant Elasticity of Variance model. Parameter values: K = 100, σ =... | Download Scientific Diagram

![PDF] ESTIMATION IN THE CONSTANT ELASTICITY OF VARIANCE MODEL | Semantic Scholar PDF] ESTIMATION IN THE CONSTANT ELASTICITY OF VARIANCE MODEL | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/a8c0361a0190e9ab20bdca613e3e10577e5d0c68/12-Figure1-1.png)

![PDF] Option pricing with constant elasticity of variance (CEV) model | Semantic Scholar PDF] Option pricing with constant elasticity of variance (CEV) model | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/8f8ce3fbade3190c56eded40b5eacbc4e48b86cb/11-Figure1-1.png)

![PDF] The Constant Elasticity of Variance Model ∗ | Semantic Scholar PDF] The Constant Elasticity of Variance Model ∗ | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/60179494f6c8288e004308b15aad83fd9cc72ea7/7-Figure1-1.png)